Tools to make you THINK differently about your business

The last two blogs have taken a peek at:

- The key differences between B2B and B2C segmentation.

- The individual components of segmentation

This, the final blog in the series will outline the key aspects of using identified segments to grow the business.

By whatever means the segmentation is arrived at, be it by judgement, by classifying the database or by research, the segments identified and targeted must pass a four-question test:

- Are the segments really different?

- Are the segments big enough?

- Do companies fall clearly into one of the segments?

- Can each company be identified as belonging to a segment?

Let’s look at each of the above questions in a bit more detail:

1) Are they really different in a meaningful way?

In determining, if and how segments differ from one another, it is helpful to give each a name, so, rather than disclosing the trade secrets of our customers we are going to use our own. Some of the segments we use are:

- Too Small Tammy – these are companies typically less than 10 people who are usually too small to be interested in our services

- Expect the World Wayne – companies that want the pile it high sell it cheap service

- Happy Handover Henrietta – These guys are often corporates (I shan’t name them) with professional managers that like to “manage” rather than “do”

- Constrained Kevin – Here we are talking about companies big enough to have managers who totally get the service we are offering, but the owners have not yet fully “let go” so Constrained Kevin does not have the authority to make the decision to appoint

- Ivan the improver – these guys are our favourite, they have a “growth mindset” and are committed to learn themselves and to develop their team. However, oddly there don’t seem to be many of them.

The name given to the segment becomes the shorthand description to identify the customer type. But if they are not really different then they are not really a standalone segment and they should be collapsed into one of the other segments.

2) Are the segments big enough?

This is really two questions.

- Are the segments big enough to justify the resource applied?

- Are the segments big enough on which to build a sustainable business?

It takes energy and resource to “service a segment” different messages, different case studies, potentially different marketing approaches. The question is, is the segment big enough to sustain the resource required?

The second question here is critical; is the segment large enough to build a sustainable business? The answer to which will depend on a number of variables, to name but a few;

- The current size of the business

- The current market share

- The size you want to get to

- The average price of the products and services delivered

- The likely response from the competition

…there is not right and wrong answer here but it is a case of working through some of the maths associated with the above variables.

3) Does each company really fall clearly into just one of the segments?

Unlike consumer segments where one week you may be flying business-class for work (one segment) and the next week you might be on a low-cost flight (another segment) for a city break with your partner, with B2B segmentation it is very unusual for a company to be in more than one segment.

4) Can each company really be identified as belonging to a specific segment?

A legitimate criticism of segmentations is that it works well in theory, sometimes not so well in practice. Creating a “partnership-focused” or “service-focused” segment is one thing but allocating companies to segments and building a sales and marketing machine around them is sometimes, quite another.

Choosing the Killer Segment

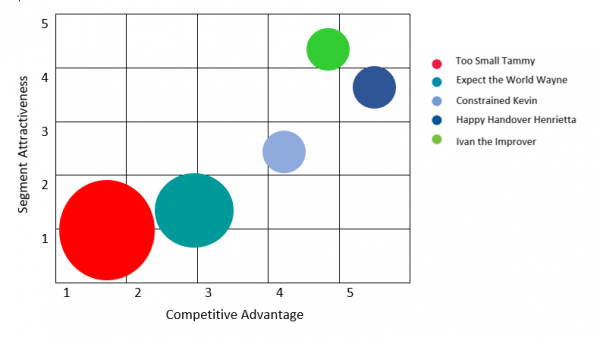

Most of us don’t have the time, money or resource to be all things to all people, so effort needs to be focused on those areas that are most likely to provide the greatest payback. By plotting the different segments on a grid, it is possible to identify which segments are worth targeting and, potentially more importantly, which are not.

Once the segments have been established it is usual to plot the segments against two factors

- The attractiveness of the segment

- Your competitive position within that segment.

From there it is possible to identify targets that justify effort and resources. In our example, even though they are the biggest chunk of the market (…96% of all UK businesses employ less than 20 people) the “The Too Small Tammy” segment offer little margin and for us are not worth targeting with our current 1:1 consultancy business model.

However, there is a perfectly legitimate question. Can a new product or service, with a different cost / delivery base, be developed just for them? (Possibly a question for a different day).

Alternatively, the “Constrained Kevin” segment may be worth developing to see if, with a bit of nurturing of Kevin’s colleagues, they can be moved up and to the right.

Conclusion

The objective of customer segmentation is to create greater focus for the time effort and money spent on marketing so that it is easier to win work in specific segments. Messages are personalised and tailored so the sales to order conversion ratio goes up. More work for less effort.

The grouping together of customers with common needs makes it possible to select target customers of interest and set specific marketing objectives for each of those segments. Once the objectives have been set, messages and strategies can be developed to meet the objectives using the tactical weapons of product, price, promotion and place (route to market).

Hopefully, in the last three blogs you now have a better idea on how to execute a process of better segmentation, better customer identification which will result in better margins.

Related tools and ideas

- The Ansoff Matrix

- The AIDA model (Awareness, Interest, Desire and Action)

Recommended references

- Market Segmentation: How to Do It, how to Profit from it – Malcolm MacDonald

Downloadable resources

To find out how Statius can help you deliver:

• Better strategies

• Better systems

• Better measurement and

• Engaged people delivering

• Better results

Call us now on 0208 460 3345 or email sales@statius.co.uk

Comments are closed