Conquering Cash Flow

Companies run into cash flow problems for a whole variety of reasons; expenses are underestimated, the labour requirement is inadequately defined, materials turn up late, invoices are delayed in being sent out and clients don’t pay on time.

Whatever the reason, cash flow problems can severely, sometimes, fatally wound, a business.

Without cash, ambitious owners are unable to reinvest in their companies. They are unable to grow. Once your customers money is in your business you need to ensure that it stays long enough to fund your day-to-day activities. Cash needs to be managed.

There’s a great book called The Machine that Changed the World which is based on the Toyota Production System, invented by a guy called Taiichi Ohno, the whole essence of which is focused on:

1) Creating perfect products

2) Reducing the cash gap in doing so

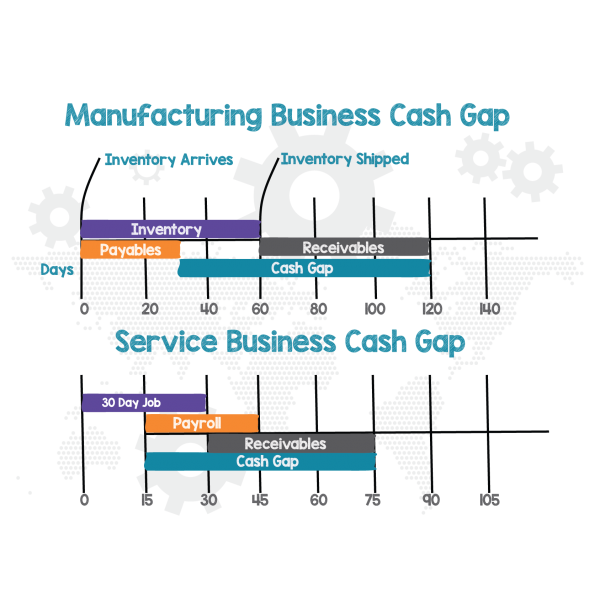

There’s more to it than this, but very basically most organisations, be they service or manufacturing, have to dish out cash at the beginning of their activities and it’s not until they get paid, usually once the job is completed, and usually at the end of the process, that they get cash back in.

This difference is the cash gap.

Some, lucky (?), organised and correspondingly very secure companies have a negative cash gap. This is where the company collects their payment before they even ship the product or deliver the service. The big and obvious examples are people like Amazon and Dell. A friend of mine I’ve known since childhood, became a director at an international coffee company, their customers paid them in advance of receiving the product and they played their suppliers on 120 days! But a negative cash gap isn’t just the realm of the big guys, think about smaller and/or local companies that operate the same way; many training companies want you to pay for training courses before you attend them, we have a client selling men’s grooming products online, again all the cash is obtained up front.

So, what happens when your business doesn’t have enough cash? It’s like running out of fuel. Cash is the lifeblood of your business. And by understanding your cash gap and the strategies to adopt to eliminate it you can identify and implement solutions to reduce the cash gap

Essentials for managing the cash gap

There are a number of fundamentals which can be tweaked in order to help with the cash gap and they might be applied slightly differently depending on whether you are a service or manufacturing organisation.

In the words of Tom Cruise in the movie, Jerry Maguire…

Show me the money – speeding up receivables

The faster you receive cash for your products and services the lower the cash gap will be. The approaches employed can be categorised, perhaps, as contractual and procedural.

Contractual processes might include:

- Upfront deposits and stage payments – so you’re not waiting until the end to get fully paid

- Incentives for paying on time, or even early

Procedural processes might include:

- Obvious, but worth making the point, is the fact that accurate, error free invoices presented in good time is a good place to start

- Good written procedures detailing the approach taken which would involve reminder phone calls, emails, statements and even, eventually, litigation.

- Good analysis – if you can establish why invoices are being delayed (internally or by clients) and resolve the issues, your cash position will improve

- Employing payment methods like PayPal or Square to ensure a fast turnaround on money owed.

Reducing client payment terms

The archetypal time for payment is typically 30 days. But why? In many service businesses the transaction is often undertaken in front of a customer with the advent of technology many organisations are increasingly requesting payment at the point of service delivery. Can you do something similar?

On a procedural level, would there be any mileage in reviewing all of your customers identifying the slow paying ones and developing different payment terms for different customers?

Controlling and reducing inventory

Many manufacturers have for a long time focused on controlling and reducing inventory. Inventories tie up cash. In fact, this is at the core of the Just in Time (JIT) story so recently in the news and also a key focus of the book mentioned above. But despite your (potentially) initial thoughts to the contrary, this is not a “manufacturing only” strategy, some service organisations that sell products, some of which they buy and store prior to selling, will easily be able to apply the same thinking.

Reducing inventory will involve taking a critical look at the speed at which stock is turned. There may be variations as a result of a variety of issues, for instance seasonal demand, shelf life, product obsolescence. Possible routes forward to reduce the cost burden would be to:

- Sell old / out of date items at a discount

- Trading items with a competitor or supplier

- Returning them to the supplier for credit

We are currently working with a small owner managed medical devices company and they have a whole store of out-of-date products, each of which has a price tag of less than a fiver. They are currently negotiating a bulk return to the supplier which the supplier would then sell on to a different parts of their international market. This could net back into the company in excess of £20k. At a 10% margin they would have to sell £200k of products to make that same £20k!

Another, essentially preventive, approach would be to review the company purchasing policies, for example to re-negotiate with suppliers for consignment or bonded stock arrangements, perhaps in exchange for a longer-term contract.

Negotiating longer supplier terms

If the gap exists because money is paid out at the front of the process and it is not received until the end of your processes, all of the above has concentrated predominantly on getting money in. Let’s not forget the other side of the equation, paying money out!

Another way to improve your cash gap is to negotiate longer payment terms with your suppliers. It may be possible to re-negotiate with suppliers extending the time that you take to pay them.

Additionally, the prices of products, services and even raw materials fluctuate, new suppliers enter the market and old ones leave. It’s certainly worth checking from time to time whether or not you could get a better deal elsewhere, or at least have your preferred supplier meet its competitors’ prices.

Planning Ahead

In the owner managed business planning ahead, and for (the inevitable) rainy day, is absolutely critical, so, even though you take all the measures possible to eliminate, reduce and avoid cash flow problems, it could be that there are events you couldn’t have anticipated. It’s always best to have good cash reserves available just in case.

Conclusion

Someone once estimated that once a payment is 120 days late, there is a 20 percent chance you’ll never collect it. A sobering thought.

The number one cause of business failure is poor cash flow. A business might be profitable, yet without cash, it will fail. This actually means that profits are in fact meaningless! It’s not necessarily a lack of money that’s your enemy, it’s simply a mismatch in the timing of paying out and receiving money.

Cash gap and cash flow is all about the timing of money changing hands and as (apparently) nearly half of UK businesses see cash flow gaps as a potential threat to their business, you gotta get it right.

A combination of sound strategy, processes and practices can help you control and manage short-term cash flow gaps, optimise your supply chain and boost growth.

Related tools and ideas

- Cash flow forecasts

- Cash flow statements (not forecasts)

Recommended references

- Rich Dad’s Cashflow Quadrant: Rich Dad’s Guide to Financial Freedom

Comments are closed